January 2021

Housing market closes the year strong

While buyer demand cooled a tad at the end of 2020, perhaps due to the holidays, the California housing market ended the year on a strong note, well ahead of 2019 levels. Mortgage rates continue to sit at record-low levels, and California is continuing to see much stronger buyer demand than is typical for this time of year.

With high buyer demand resulting in a surge of business for lenders, mortgages are now taking longer to close; the average time it took a mortgage to close in November 2020 was 55 days. This can adversely affect borrowers who lock in specific rates for a 30 or 45 day period. And as of December 1, approximately 2.8 million homeowners were on a forbearance plan, with data showing forbearance rates are highest among higher-priced loans.

Realtor.com's top 10 housing markets for 2021 have substantial momentum from 2020 which they will carry into 2021. Economic momentum from the thriving tech industry, coupled with healthier levels of supply, will position these markets for growth in 2021. This past year, we've all become more reliant on technology to work, learn, and maintain personal connections. The technology hubs that make this possible are thriving, as are their housing markets. Additionally, the relative stability of government jobs in the past year has driven home prices and sales in several state capitals to the top.

The Sacramento-Roseville area is ranked as #1 as a market positioned for growth in 2021 with a sales growth of 17.2% and a price growth of 7.4%. The San Jose-Sunnyvale-Santa Clara is ranked #2 and projects a sales and price growth of 10.8%. These areas are followed by Charlotte, NC; Boise, ID, and Seattle-Tacoma as the top 5.

The average FICO score reaches a record high in 2020

While 2020 was a year of economic uncertainty for many Americans, the average FICO Score still managed to hit a record high of 710, according to Experian's 2020 Consumer Credit Review. That is a seven-point increase from 2019 and up a whopping 21 points since 2010. The rise in credit scores can be attributed to Americans spending less money and paying their credit card statements on time.

California's average FICO score rose 8 points in 2020 to reach 716. In addition to credit scores hitting a new high, consumers in all 50 states and Washington D.C. saw a rise in their average credit scores by three to 10 points.

Pandemic inspires home design changes

The pandemic is influencing home design in ways that are likely to continue for years to come. For example, garage space is getting more attention, and cleanliness is continuing to remain prominent. According to the America at Home Study, based on nearly 4,000 respondents nationwide and conducted in October and November.

From cooking more at home, Zoom holiday parties, and managing online learning to online ordering of virtually everything, the pandemic has accelerated many changes that were already underway. Many of these routines will undoubtedly ebb and flow as the pandemic does. Understanding these differences, coupled with new product preferences by generation, will help create new homes that reduce the pains causing friction and elevate the gains a new-home buyer is hoping for.

Source: Builder Magazine

Where is your favorite grocery store?

ATTOM Data Solutions, curator of the nation's premier property database, today released its annual 2020 Grocery Store Wars analysis, which shows how living near a Trader Joe's, a Whole Foods or an ALDI might affect a home's value - as a homebuyer based on home price appreciation and home equity, or as an investor looking for the best home flipping returns and home seller ROI.

For this analysis, ATTOM looked at current average home values, 5-year home price appreciation from YTD 2020 vs. YTD 2015, current average home equity, home seller profits, and home flipping rates in U.S. zip codes with a least one Whole Foods store, one Trader Joe's store and one ALDI store. (See full methodology enclosed below.)

How Coronavirus changed the California housing market

Coronavirus has touched every corner of life in California, and the real estate market is no exception. Some might think home prices would be low due to the pandemic. There's competition. That does not mean there's a deal, if you have multiple people interested, it tends to raise the price. Inventory of attractive homes is lower than it's been in at least 10 years, which has fueled competition and kept prices high.

The impact of coronavirus goes deeper than just prices, though - it's also changing what people value in their new living space. People are wanting multiple office spaces, different places to gather, separate areas are important as well as outdoor living. We have been stuck in our homes for so long now, we are all very aware of the downfalls of our own homes, and maybe now we want something different.

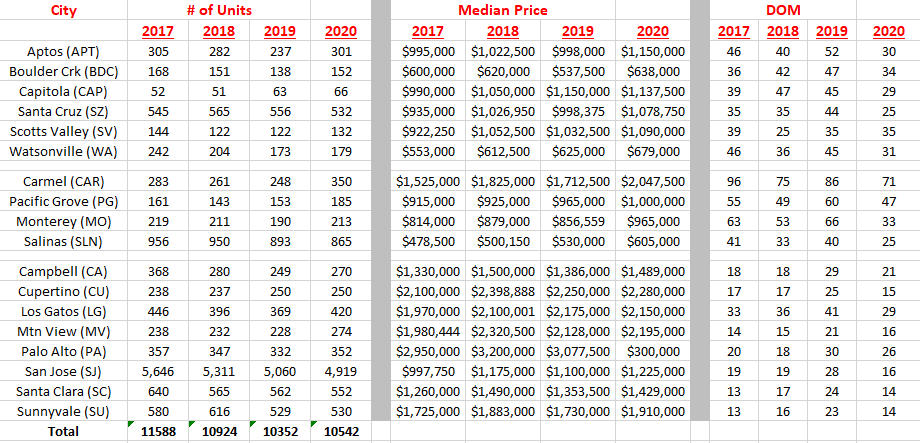

Fourth Quarter Comparisons for Santa Cruz, Monterey and the Bay Area

Comments: In all three counties, new listings are down, and the number of sales is down but as one would expect the median price is up.... same ole same ole. Days on the market increased due to the rise in Covid-12 cases and the inability to see properties. The list to sales price indicates there are some good buys to be had. (Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS)