JANUARY 2024

Concerns are growing over the rising cost of homeowners insurance.

According to Housing Wire, the rising cost of homeowner insurance is weighing more heavily on American homeowners and buyers, according to a survey published by Mphasis Digital Risk, a tech services company that serves the real estate lending industry. The vast majority (90 percent) of respondents expressed concern about rising home insurance costs, and 27 percent said that they were considering moving to a different state to get away from increasing insurance costs.

Although the higher cost of insurance might be daunting, 53 percent of respondents said that they would move to a higher-tax location for better weather. Despite insurance concerns, tornadoes were the top natural disasters that people were concerned about impacting their property value, at 46 percent, followed by flooding at 45 percent, hurricanes at 42 percent and landslides at 20 percent.

16% of home listings nationwide were affordable in 2023.

Across the U.S., just 15.5 percent of homes for sale in 2023 were affordable for the typical U.S. household, which was the lowest share on record, according to a Redfin analysis of new listings in 97 of the most populous U.S. metropolitan areas. In 2022, 20.7 percent homes were affordable, and more than 40 percent before the pandemic homebuying boom. A listing is considered affordable is the estimated monthly mortgage payment is no more than 30 percent of the local county's median household income.

The good news is that housing affordability has already started to improve and it is expected to continue improving in 2024. "Many of the factors that made 2023 the least affordable year for homebuying on record are easing," said Redfin Senior Economist Elijah de la Campa. "Mortgage rates are under 7 percent for the first time in months, home price growth is slowing as lower rates prompt more people to list their homes, and overall inflation continues to cool. We'll likely see a jump in home purchases in the new year as buyers take advantage of lower mortgage rates and more listings after the holidays."

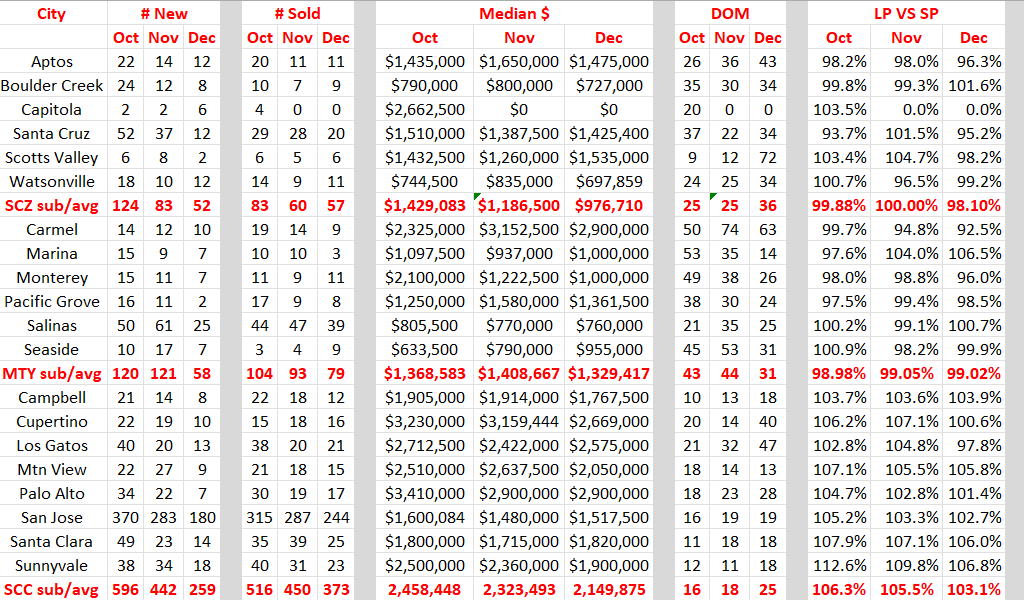

2023 4th Quarter Stats for Santa Cruz, Monterey & Santa Clara counties

(Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS as of 12/30/23)

Comments: I was thinking of showing the results for the entire year and all categories but then I realized I have been keeping you updated on this past year's stats and actually nothing is new. Same ole, same ole!! Looking at the last quarter you can see that new listings are down, sales are down, and for the first-time prices are down (notice Cupertino, Palo Alto and Sunnyvale). Days on the market are up in Santa Cruz and Santa Clara counties and List to Sale Price has dropped across the board. The prognosticators say inventory will increase in the first quarter of this year as well as interest rates dropping. We can only hope. Stay tuned.

Share of homebuyers relocating at lowest level in 18 months

The share of U.S. homebuyers looking to move to a different metro area declined for the third straight month in November, dropping to 23.9%, the lowest share in a year and a half. That's down from 24.1% a year earlier-a tiny drop, but the first annual decline in Redfin's records-and down from a record high of 26% over the summer.

Overall homebuying slowed in 2023 because it was the least affordable year on record and there was a severe supply shortage. There were 4% fewer Redfin.com users looking to move to a new metro in November than a year ago, compared with a 3% year-over-year drop for Redfin.com users searching within their home metro. The slightly bigger drop for house hunters looking to relocate explains why migrants are making up a smaller share of overall home searchers. It will be interesting to see whether the migration rate declines or increases in the new year, as we expect home sales to increase as mortgage rates come down.

The portion of house hunters who are relocating to a new area is coming down for a few reasons. One, there's less flexibility to work remotely as employers call workers back to the office. That means the flow of homebuyers moving from the Bay Area to Austin, TX or Boise, ID, for example, has slowed. Two, home prices generally increased more in popular migration destinations than they did in expensive coastal metros during the pandemic, making the case for moving a bit less compelling. For example, prices in Sacramento-the most popular destination this month-are up about 35% since before the pandemic, compared with an 8% increase in the Bay Area.

More homebuyers are leaving Los Angeles than any other metro area in the country. That marks the first time on record it has been the number-one place homebuyers are leaving, and the first time in over two years the Bay Area has dropped out of the number-one spot. The Bay Area comes in second, followed by New York.

Has Renting Eclipsed the American Dream of Home Ownership?

In 1995, President Bill Clinton released his National Homeownership Strategy, a lengthy, 100-point plan with the eventual goal to "boost homeownership in America to an all-time high by the end of the century." Eight years later, President George W. Bush looked at homeownership as a means of reducing racial inequality, signing the American Dream Downpayment Initiative to help first-time homebuyers land a home.

But that move brought us to the most catastrophic mortgage crisis in U.S. history, igniting the Great Recession of 2008-09, resulting in more than eight million home foreclosures. In the United States today, according to analysis by real estate services and investment firm CBRE, buying a home is now 52 percent more expensive than renting.

This type of economic reality is leading some to believe that renting has replaced home ownership, which has been one aspect of the American dream.

A former CFO for real estate agency Keller Wiliams in Manhattan, Mr. Ritacco says the biggest cause of the dream shift is the Federal Reserve's decision to raise interest rates from near zero in March 2022 to a range of 5.25-5.5 percent by the summer of 2023. "It's supposed to happen slowly. What they did is like driving a Ferrari 100 miles an hour, pulling the emergency brake and going through the windshield. When you talk about crushing the American dream, that's how it happens."

Those factors have contributed to even the well-heeled and famous residents of New York deciding to rent rather than buy, according to Mr. Ritacco.

Here's how much you need to make to afford a home in America.

The income of a typical homebuyer in the United States surged to $107,000 from $88,000 last year, as home affordability precipitously worsened, according to an annual report from the National Association of Realtors. The 22% jump was the highest annual increase on record and puts homeownership out of reach for many families in the United States, where the median income is about $75,000, according to the Census Bureau. "The household income for those who successfully purchased homes jumped by nearly $20,000 and topped six figures for only the second time in our records," said Jessica Lautz, NAR deputy chief economist and vice president of research.

As a result, buyers' typical down payments jumped to the highest share of home purchase price in two decades - 8% for first time homebuyers and 19% for repeat buyers - as buyers pulled together larger down payments to break through competitive bidding wars or to lower the amount of the purchase that was financed with a mortgage.

First-time buyers made up 32% of all homebuyers, up from last year's 26%. While this is an increase, it is well under the 38% historical average. "First-time buyers tiptoed back into the market this year with less competition and fewer multiple-offer scenarios," said Lautz. "While the share of first-time buyers is still near historic lows, it is higher than last year. Notably, today's first-time buyers had household incomes nearly $25,000 above last year and are more likely to use financial assets to enter the market."

The age of a first-time buyer this year, at 35, is down slightly from 36 last year, but above historical averages. The age of the typical repeat buyer also dropped slightly to 58 from an all-time high of 59 last year. The makeup of the households able to buy homes continues to shift, according to the report. Families facing higher costs because they have children are getting pushed further out of the homebuying picture.

An overwhelming 70% of recent buyers did not have a child under the age of 18 in the home, which was the highest share recorded in this study. By comparison, in 1985, only 42% of households did not have a child under the age of 18. The share of married couples dropped to 59% percent of recent buyers - the lowest share since 2010 - while the share of single female buyers and single male buyers increased to 19% and 10% respectively. About 9% of buyers were unmarried couples.

Homebuyers became more diverse this year, with the share of white homebuyers dropping to 81% from 88% last year. Of recent homebuyers, 7% were Latino, 7% were Black, 6% were Asian or Pacific Islander and 6% identified as some other race. In addition, 38% of first-time home buyers identified as non-White or Caucasian, compared to 17% of repeat buyers.

"Homebuyers in the past year were more diverse, both racially and ethnically, with increases noted among minority buyers, buyers who were born outside of the US and buyers whose primary language is not English," said Lautz. The shift is an encouraging move toward closing the homeownership gaps that exist between white homeowners and other groups.