May 2022

CA program helps 1st-time buyers with forgivable loans

California is now offering forgivable loans to middle-class home buyers who struggle to make down payments amid spiraling house prices. For middle-class families, especially those in Black, Hispanic and immigrant communities, building generational wealth through long-term home ownership has been tough, so the state wants to give them a helping hand.

The new Forgivable Equity Builder Loan program allows qualified, first-time buyers to borrow up to 10 percent of a home's purchase price and have the debt forgiven if the buyer lives in the home for five years. The loans are available to middle-income families making less than 80 percent of their county's annual median income - or below $60,000 a year in Los Angeles County, or below $77,000 in Orange County.

As reported by Yahoo finance, first-time homebuyers looking to purchase a starter home typically ranging from 1,900-2,400 square feet are having a difficult time because these homes are in short supply, according to experts. It is much harder to find and build homes in smaller quantities in today's market given the demand, space challenges and potential regulatory burdens.

In 1999, 37% of newly built single-family homes were smaller than 1,800 square feet, but by 2020, that share had fallen to 25%, according to the National Association of Home Builders. In comparison, in 1999, 66% of newly built single-family homes were smaller than 2,400 square feet while in 2020, that share had fallen to 57%.

What homebuyers view as the most difficult part of the process

Buying a home is not easy as anyone who has recently gone through the process can attest. More than half of homeowners say the hardest part of buying a home starts before trying to convince a seller you're the right person to purchase their home and going through inspections. According to the National Association of Realtors 2022 Home Buyers and Sellers Generational Trends Report, 56% of all buyers said finding the right property was the hardest part of buying a home.

Meanwhile, 18% found the paperwork involved to be the most cumbersome. 15% said that understanding the process and steps of a home purchase was hardest and 13% admitted that saving for the down payment proved the most difficult part of the journey. Just 18% of all buyers said they didn't feel that any of the necessary steps were difficult.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances decreased to 5.36% from 5.37% for loans with a 20% down payment. Mortgage applications to purchase a home rose 4% for the week but were still down 11% year over year. Refinance applications rose 0.2% for the week but were still 71% lower than a year ago.

More homebuyers are now turning more to adjustable-rate mortgages which offer a substantially lower interest rate and can be fixed rate for up to 10 years. The ARM share of activity remained unchanged at 9.3% of total applications, but that is more than twice the share it was a year ago, according to CNBC.

Check out this chart which shows how buying power has changed in just 3 months.

In the context of ongoing geopolitical tension, record inflation, and rising interest rates, current indicators of the broader economy and the housing market continue to outperform. However, there are rising signs that the second half of 2022 and 2023 may be more challenging.

Despite a significant jump in mortgage rates, there are myriad signs of robust buyer demand in the latest weekly data. Some buyers may be feeling a sense of urgency to complete their transactions before rates rise further next year. The percentage of homes closing above asking price remains elevated at 72% of transactions last week. In addition, the median days on market for homes sold last week held steady at just 11 days. That means that the market was more competitive during the final week of April 2022 than it was during the summer of 2021.

Although California has been experiencing a seasonal uptick in inventory for the past few months, growth in active listings over the past few weeks has become much more meaningful. California ended April with nearly 30,000 homes available for sale across the MLS, collectively. That represents more than a 12% increase in inventory-the largest gain since before the pandemic began. That still leaves the state well behind pre-pandemic levels of available listings, but the acceleration in the pace of inventory coming online means that buyers will begin to have more options to choose from than they've seen in several years.

Last week I attended our annual CAR Legislative Day in Sacramento. It was an opportunity to gather with constituents and show my support for a legislative agenda that promotes homeownership opportunities for working Californians, and those who are members of groups who have been historically discriminated against in the housing market.

It was the first time since 2019, that we had all been together. Over 2,000 Realtors from across the state joined together on April 27th to hear Gov. Gavin Newsom, Senator Robert Hertzberg, Senate Majority Leader Emeritus and Assembly Member James Gallagher.

Opposition to AB 2469 (Wicks) Statewide Rental Registry: This bill would have established a statewide rental registry that would force housing providers to annually submit, and continually update, proprietary business information to the California Department of Housing and Community Development. Those housing providers who failed to submit this information would have been unable to raise the rent or evict a tenant - even an unscrupulous tenant engaged in criminal activity. 2469 failed to pass out of the Assembly Housing and Community Development Committee by the Legislature's policy committee deadline.

Opposition to AB 2710 (Kalra) Residential Real Property; Right of First Offer: This bill would have prohibited rental property owners from selling their property to someone other than a so-called "qualified entity" for up to almost one year. The bill would have applied to applied to any residential multifamily property and any single-family home or condo with a current tenant. The rental property owner who wished to sell their property would have had to first provided a "disclosure package" to each "qualified entity." Depending upon the circumstances, such as the type of property and the entity's ability to secure financing, AB 2710 provided that this process could potentially take anywhere from several months to up to almost 1 year. 2710 was pulled by the author from its scheduled hearing in the Assembly Housing and Community Development Committee.

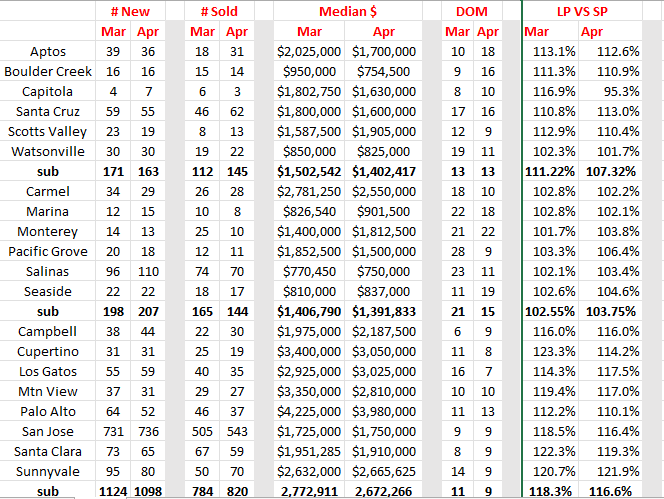

Comments: As I suggested last month, we are seeing some changes now happening. My first observation is the overall decline in the median price. Both Santa Clara and Santa Cruz counties showed declines in the list to sales price ratio. New listings were also down 4.6% in Santa Cruz and 2.3% in Santa Clara even though both counties showed an increase in sales (were some of those already in escrow). The days on the market declined across all three, showing urgency on behalf of some buyers. Once again, is the uptick in interest rates having an impact? This is the time of the year when sales normally increase along with price. Will it happen in May? (Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS)

Weekly mortgage demand rises even though rates are higher

California's housing market shrugging off challenges thus far

Opposition from REALTORS® help defeat 2 bad rental housing bills

March-April Comparison Stats for Santa Cruz, Monterey & the Bay Area