June 2021

Same ole, same ole, different month...

The California housing market is seeing more residents move out of big cities to once-sleepy suburbs and exurbs. But the reports of Californians leaving the state en masse are exaggerated. I have not had any sellers leave CA, only relocating to other areas in CA for one reason or another. In addition, I have buyers wanting to move to Santa Cruz County from LA and Northern CA to experience life on the coast.

According to a recent study by Redfin of 400 metro areas, more than half of homes nationwide sold above listing for the four-week period ending on May 23. These numbers illustrate the severe lack of inventory nationwide. Check out the stats graph below for greater detail.

Some banks, including Bank of America and Chase, could resume foreclosures as soon as July, with the federal foreclosure moratorium set to expire on June 30. There are currently around 2.1 million homeowners on forbearance plans. Mortgage rates fell below 3 percent again last week but are likely to rise again soon.

Appliances, furniture, and lumber shortages causing headaches.

House hunters who may have overcome inventory challenges to finally find a house are experiencing inventory shortages in furnishing their new home. New-home buyers continue to scramble to find appliances and furniture as manufacturing shortages loom. And, the shortages aren't expected to ease anytime soon, and in some cases, they're delaying transactions from closing.

I recently remodeled my kitchen and found that unless I bought what was in stock I may have to wait months for appliances. I was lucky enough to have found what I needed at Home Depot and some granite that fit my color scheme which were left from another job at Tile & Marble Outlet. I started the remodel on May 25th and my contractor is due to be finished this Friday. I am feeling incredibly lucky.

Millions more will enter the housing market in 2021.

According to Housing Wire, and in what will be known to future generations as the Great Reshuffling, a recent Zillow survey showed that more than 1 in 10 Americans reported moving in the past 12 months, either by choice or by circumstance. And now, with the COVID-19 vaccine circulating and the economy slowly regaining strength, Zillow researchers say millions of additional households could enter the housing market in 2021. Among the surveyed movers, approximately 75% reported moving for positive reasons, such as being closer to family or friends or living in a desired part of the country.

So-called "secondary cities," in fact, have seen a massive influx of movers looking to take advantage of bigger homes and larger lots for a fraction of the price they would pay in a metro area. Specifically, housing markets like Portland, Maine, Bay City, Mich., Pueblo, Colo., and a slew of zip codes in Idaho have become popular mover destinations since the onset of COVID-19.

Zillow also reported an uptick in movers to the South over the past year - specifically, to the Sun Belt cities of Phoenix, Charlotte, N.C., and Austin. Inversely, data from Zillow showed for-sale inventory climb the highest in four major real estate markets - Los Angeles, Chicago, San Francisco, and New York.

Finally, Zillow's housing market report underlined how important the accelerated development and adoption of real estate technology was in the last 12 months, and how buyers and sellers will be relying on it going forward. Approximately 80% of those surveyed said they would like to view a virtual home tour and a digital floor plan before buying if they were shopping for a home.

Homebuyers may be growing weary.

Homebuyers are feeling pretty discouraged by the housing market these days. The latest Fannie Mae Home Purchase Sentiment Index shows that just 35% of consumers believe now is a good time to buy a home, down from 47% in April. And those who believe it is a bad time to be a homebuyer increased to 56% from 48%.

Despite the challenging buying conditions, consumers do appear more intent to purchase on their next move, a preference that may be supported by the expectation of continued low mortgage rates, as well as the elevated savings rate during the pandemic, which may have allowed many to afford a down payment.

The severe lack of inventory in today's housing market has been a source of stress for home buyers and real estate agents alike. Because the housing market feels very much like a zero-sum game at this point, sellers again felt good about their position. Just over two-thirds of those surveyed in June said it was a prime time to list a home and tempt the swarms of homebuyers, unchanged from the prior month.

Mortgage rate expectations changed a bit in May for prospective homebuyers and sellers. Since rates have fallen back below 3% once again, Fannie Mae's economic and strategic group revised its expectations for purchase and refinance volume.

Borrowers who aren't stuffing their pockets full of refi savings may be making it up on the job market. The percentage of respondents who say their household income is significantly higher than it was 12 months ago increased from 21% to 29%, while the percentage who say their household income is significantly lower decreased from 17% to 13%. To top it off, the percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 80% to 87%

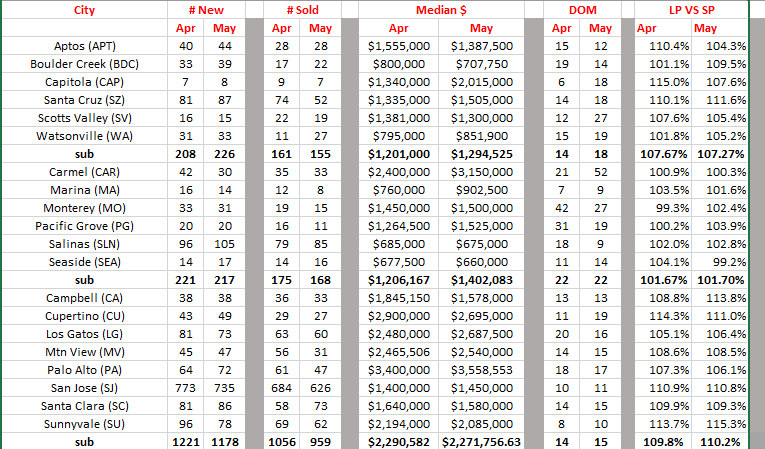

April-May comparisons for Santa Cruz, Monterey & the Bay Area

More listings and less sales in Santa Cruz County with less listings and less sales in Monterey and Santa Clara counties. Is buyer hesitancy or lack of inventory the reason? Median price showed an increase overall but mainly due to a couple of areas that always run higher than normal, i.e.: Capitola, Los Gatos, Palo Alto. Days on the market and the list to sale price remain mostly the same month over month. I am projecting a significant change come June/July. We shall see! Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS.