JUNE 2024

NAR Settlement and what it means to the consumer.

What consumers should know after August 17, 2024:

Open Houses in a post NAR-Settlement world

A practice changed by the NAR settlement is that all MLS participants working with a buyer must enter into a written agreement before the buyer tours any home. This has raised questions about how agents should handle visitors to open houses.

The answer varies depending on the type of relationship (if any) that the agent and visitor desire to enter into. The best practice is to ask adult visitors to sign in. Starting in late June 2024, the visitor will be acknowledging that the agent at the open house is acting on behalf of the seller and is not representing the buyer.

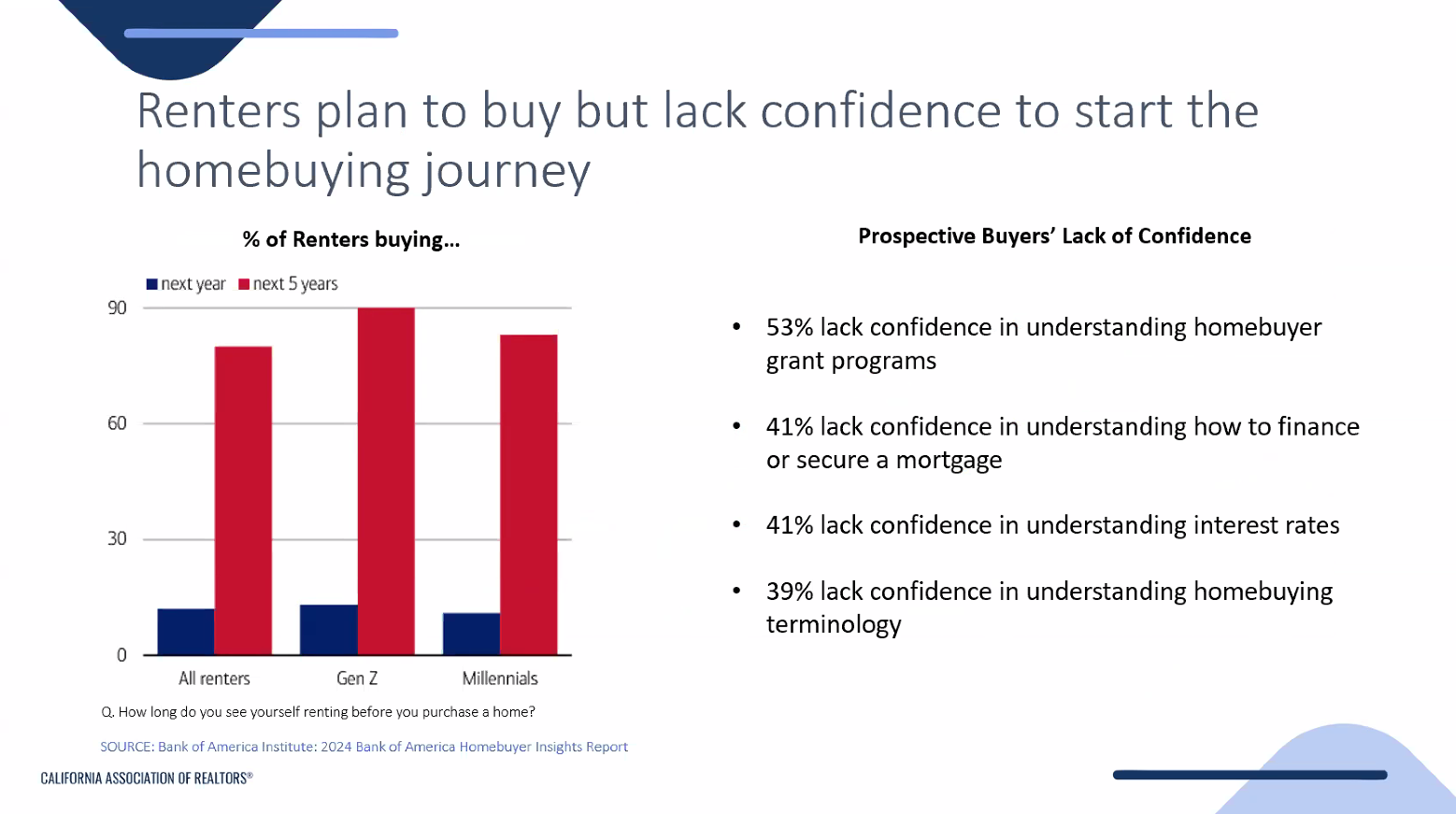

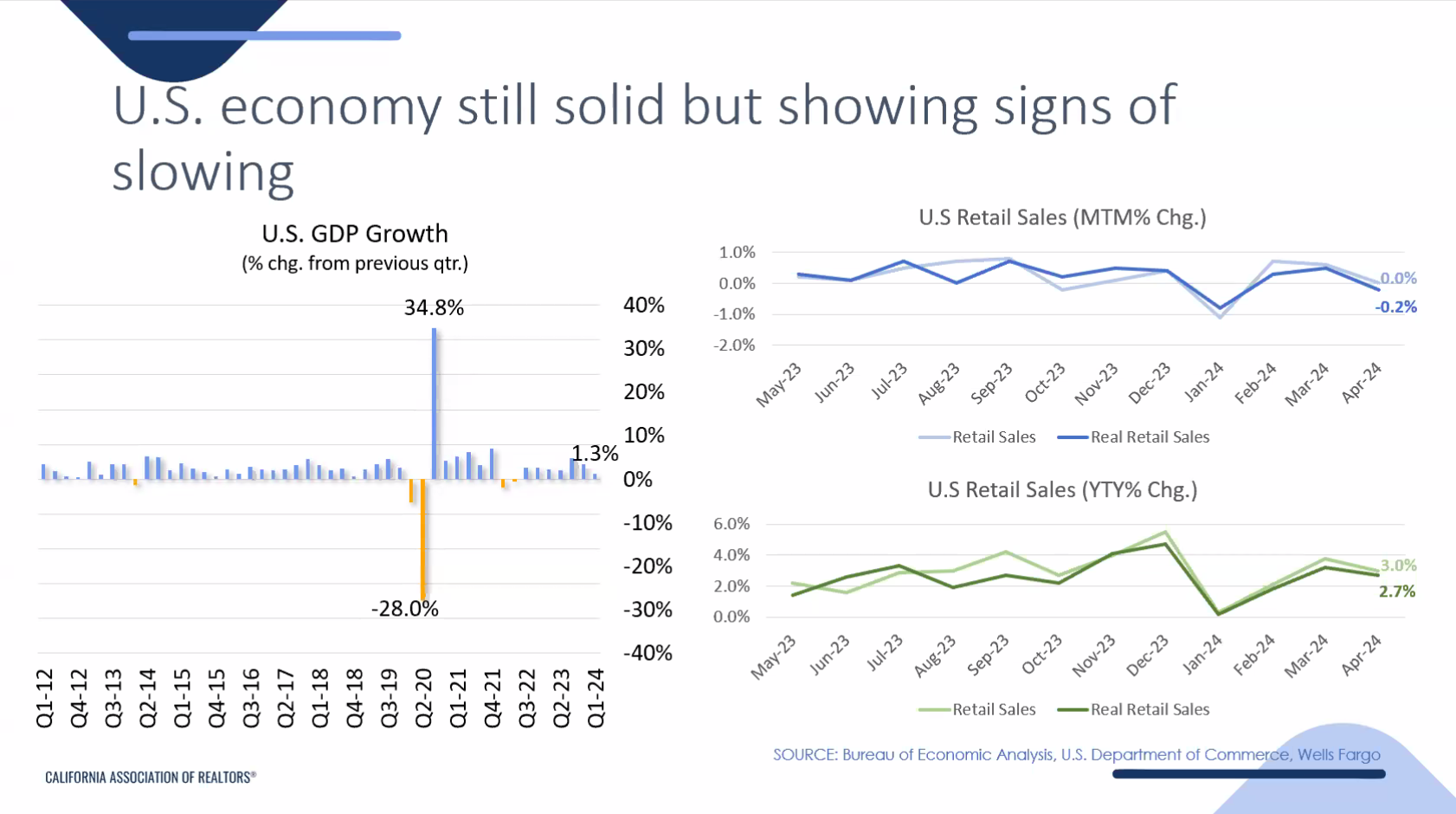

Current statistics presented by the C.A.R. Chief Economist

Why aren't people buying vacation homes? Does this explain what is happening in Santa Cruz County

In 2023, homebuyers took out 90,772 mortgages for second homes, which was a 40% decrease from 2022 and 65% lower than the 2021 level. The report notes that 2024 appears on track to be another slow year for vacation home purchases. The number of primary home mortgages also declined significantly from 2022 to 2023, but only by half as much as mortgages for secondary homes (a 20% decrease vs. 40%). There are multiple reasons for the steeper decline in second home purchases:

The high cost of the typical vacation home ($475,000) led to reduced demand in 2023, Mahmood-Corley says. (The typical value of a primary home is $375,000, according to Redfin.) The Federal Housing Finance Agency raised loan fees for second-home mortgages in 2022. High mortgage rates are suppressing demand for primary homes as well as vacation homes. But rates are usually significantly higher for second-home loans because lenders know they're riskier.

Second home mortgages boomed during the pandemic when Americans had a greater ability to travel thanks to remote work policies. The shift back to more in-office work has made the idea of buying a vacation home less appealing overall.

Lastly, fewer people are buying second homes with the plan to rent them out or list them as short-term rentals. Redfin said there's less money to be made from those activities than there was two years ago. Second-home mortgages made up only 2.8% of the total mortgage market last year, which is a decrease from 5.1% in 2020. Primary home mortgages represented an 88.6% share of all mortgages last year, while investment property mortgages were 8.6%.

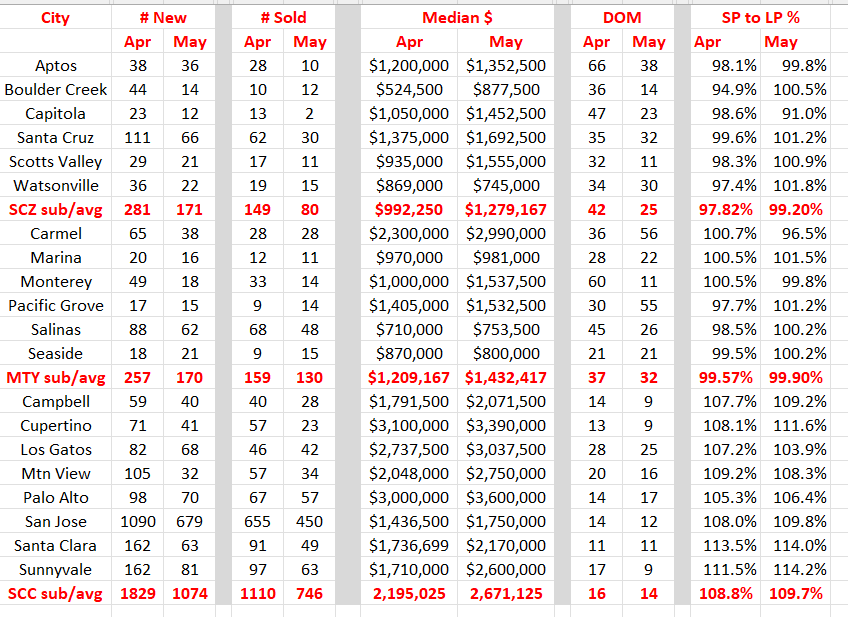

April - May '24 Stats for Santa Cruz, Monterey & the Bay Area

Comments: Well, I said I couldn't wait to see what happens in May, but I never expected this!! May always exceeds April and look at these numbers. Down across the board for new listings and sales. And not just down...down 39%, 35% and 41% respectively for new listings. And down 46%, 18% and 33% for sales. WOW!

So, let's look at the median price numbers and as you might expect, UP, UP, UP! Days on the market down and sales to list price up as well. Now this makes me wonder what price ranges are selling. When I look at Santa Cruz, 88 out of 150 sales were over $1M. In Monterey, 97 out of 209 sales were over $1M, 13 over $2M and 19 over $3M and beyond. In Santa Clara, 1,112 out of 1,336 sales were over $1M. And besides that, 33-40% of all sales are cash buyers.

Once again, these results were a total surprise to me. I have been tracking stats for almost 25 years and the only anomalies have been 2008 and then 2021. Is another housing recession looming? (Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS)