July 2022

SoCal and Bay Area housing markets predicted to slow

As reported by the LA times, real estate analysts are predicting that rising mortgage rates will slow the housing market across the nation and Southern California. With sales down, inventory rising, many prospective buyers and sellers are wondering whether home prices will fall.

As the slowdown deepens, the prospect is growing more likely with some analysts now adjusting their forecasts to call for price declines next year, marking a shift from earlier this year, when there was greater expert agreement that rising mortgage rates would simply slow price appreciation. That is: Prices would keep climbing but less than they had in the last two years.

According to the SF chronicle, the Bay Area housing market is showing signs of cooling as mortgage rates have been on the rise since the beginning of the year. While home buyer demand is still strong in the Bay Area compared to elsewhere, and inventory still scarce, the Bay Area housing market is normalizing and seeing less intense competition.

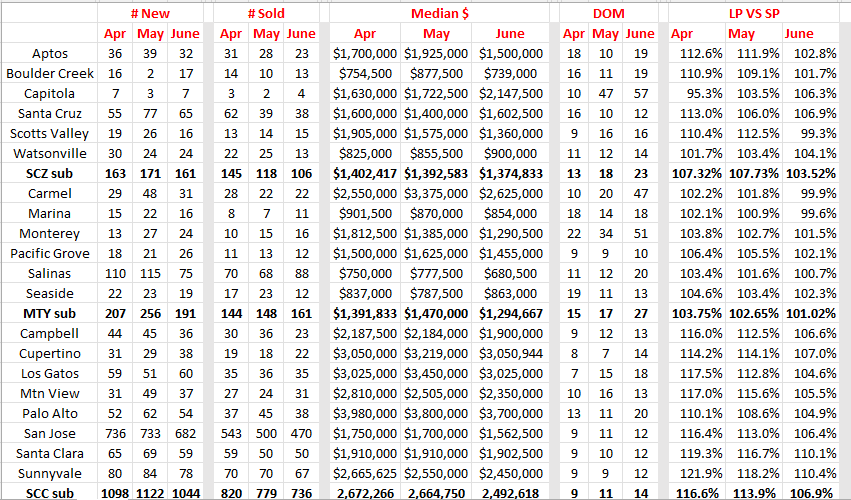

Some signs of a real estate slowdown are a decline in the number of home sales, price drops and lower sale-to-list price ratio, which indicates what homes are selling for versus their list prices. Industry experts are seeing a sales slowdown and anticipate a continues slowdown in the coming months and possibly into the second half of 2022 as more interest rate hikes are expected. For the most current stats for the Bay Area, see the chart below.

New construction home costs rising at unparalleled rate

Homebuilding costs are rising at an unprecedented rate as inflation continues to push up home prices, which are being passed on to home buyers. Supply-chain disruptions and labor shortages are also adding pressure to rising prices, according to Bank of America’s Who Builds the House? report.

The average cost for materials to build a single-family home jumped 42% from 2018 to 2021, adding thousands of dollars to the price of a new home, according to the report. The median sales price of a new home in April reached a record $450,600, a 20% hike from a year earlier, Commerce Department data shows.

San Jose and San Francisco have more new listings than pre-pandemic

Two California cities – San Francisco and San Jose – are among six U.S. cities that have more new listings than they did pre-pandemic (measured by looking at the average of new listings — properties on the market for 14 days or less — from Jan-Apr 2022 vs. the average for Jan-Apr 2017-2019).

Industry experts say pandemic-related remote work that’s shifted housing demand away from less affordable urban markets toward more affordable markets is driving the uptick in new listings in some markets. The other four cities are Seattle, Portland, San Antonio, and Kansas City.

Did you know?

Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about 10 times the median value of families' financial assets. Over the past decade, a homeowner who purchased a single-family existing home would have gained more than $229,000 in home equity if the home were sold at the median sales price in the fourth quarter of 2021.

AND…

Nearly 75% of Americans say that owning a home is a more significant measure of achievement than having a successful career or even raising a family, according to a survey from Bankrate.com of about 2,500 adults. Homeownership topped being able to retire (66%), having a successful career (60%), owning an automobile (50%), having children (40%), and earning a college degree (35%).

AND…

Although foreclosures are up 132% from a year ago, most real estate analytic experts say there is no need to worry. Even though delinquencies are often a sign of distress or weakness in the housing market, there is little effect on the current housing boom.

Why this housing market is not a bubble ready to pop.

Here are two reasons today’s market is nothing like the one we experienced 15 years ago.

Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Today, purchasers and those refinancing a home face much higher standards from mortgage companies.

There’s always risk when a bank loans money. However, leading up to the housing crash 15 years ago, lending institutions took on much greater risks in both the person and the mortgage product offered. That led to mass defaults, foreclosures, and falling prices.

Today, the demand for homeownership is real. It’s generated by a re-evaluation of the importance of home due to a worldwide pandemic. Purchasers can afford the mortgage they’re taking on, so there’s little concern about possible defaults.

When prices were rapidly escalating in the early 2000s, many thought it would never end. They started to borrow against the equity in their homes to finance new cars, boats, and vacations. When prices started to fall, many of these homeowners were underwater, leading some to abandon their homes. This increased the number of foreclosures. Homeowners didn’t forget the lessons of the crash as prices skyrocketed over the last few years.

The major reason for the housing crash 15 years ago was a tsunami of foreclosures. With much stricter mortgage standards and a historic level of homeowner equity, the fear of massive foreclosures impacting today’s market is not realistic.

2nd Qtr. Comparison Stats for Santa Cruz, Monterey & the Bay Area

Comments: New listings declined in June in all three counties as did the median price and list to sale price ratio. Days on the market increased all over and sales declined in two out of the three counties. That’s it in a nutshell, as I had mentioned in past articles and what we are learning from the news. The economy, inflation, the war in Ukraine, the pandemic has all had an effect and may continue to do so through the end of the year and into 2023. (Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS)