JULY 2023

Five solid reasons to buy a home now, despite high rates.

According to a recent survey from Realtor.com, homebuyer ambivalence is high for good reason. Some buyers might be encouraged to hear that last year's red-hot seller's market, with its bidding wars and over-asking offers, has finally ebbed. But mortgage rates are a full percentage point higher than last year, making it more expensive for homebuyers.

Experts say currently, there are fewer buyers in the market because of rising interest rates and uncertainty in the market. However, conditions have been improving for buyers, so right now is actually a better time to buy than the first half of 2023. Whether it makes sense to buy a house now boils down to a number of economic and personal factors.

Reasons to hold off on buying a house.

FHA vs. conventional loan, which mortgage is right for you?

If you need a mortgage to buy a house, you may find yourself choosing between an FHA loan versus a conventional loan, according to Realtor.com. What's the difference, and which one is right for you?

While the majority of homebuyers might assume they should get a conventional home loan, about 40% end up with FHA loans. Conventional lenders look for borrowers who have well-established credit scores, solid assets, and steady income. As such, these loans have higher barriers to entry than the FHA-backed options.

Typically, you need at least a 620-credit score and ideally a 20% down payment, although you can put down as little as 3% if you so wish (this is generally reserved for first-time homebuyers). Just know that on any down payment under 20%, you'll have to pay private mortgage insurance, an extra monthly fee meant to mitigate the risk to the lender that you might default on your loan. (PMI ranges from about 0.58% to 1.86% of your home loan.). Most conventional loans also require a maximum 50% debt-to-income ratio, which compares how much money you owe (on student loans, credit cards, car loans, and-hopefully soon-a home loan) with your income.

FHA loans are great for first-time buyers or people without sterling credit or much money. To qualify for an FHA loan, you need at least a 3.5% down payment and a credit score of 580. Applicants with lower credit scores (e.g., 500) may not be out of the running entirely but must cough up a larger down payment of at least 10%. These loans also have debt-to-income requirements of less than 43%. FHA loans may be a boon to homebuyers (particularly first-timers) who might not qualify for a loan otherwise, but they do have a few disadvantages.

Generally, if you have the means and qualifications to afford a conventional loan, this is the one to opt for, since it has fewer restrictions (and is faster to get). However, if you're a less-than-ideal homebuyer with a mediocre credit score, down payment, or income, then an FHA loan may be the best-or only-avenue open to you.

May home sales and price report from C.A.R.

California's housing market rebounded in May as home sales surged to the highest level in eight months and the statewide median price notched above $800,000 for the second straight month, as reported by the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.).

Sales declines moderated at the regional level, with sales in all major regions falling less than 24 percent from the same month last year. The San Francisco Bay Area experienced the biggest sales drop at -23.8 percent from a year ago, followed by Southern California (22.3 percent) and the Far North (21.8 percent). The Central Coast (-17.3 percent) and the Central Valley (-20.0 percent) were the only regions that recorded a drop of 20 percent or less from last year.

Forty-nine out of 51 counties tracked by C.A.R. registered a sales decline from a year ago in May, with 36 counties dropping more than 20 percent year-over-year and nine counties falling more than 30 percent from the same month last year. Mariposa (-51.5 percent) had the biggest sales dip in May, followed by Siskiyou (-45.5 percent) and Mendocino (-44.3 percent). Tehama (2.6 percent) was the only county with a year-over-year sales gain.

More than 80 percent of all counties experienced a decline in their median home price from a year ago in May, with 12 counties sliding more than 10 percent on a year-over-year basis. Siskiyou (-30.4 percent) had the biggest drop of all counties, followed by Plumas (-29.6 percent) and Lassen (-25.7 percent).

Housing inventory in California dipped in May after a brief bounce back in April, as sales improved while supply remained tight. The statewide unsold inventory index (UII) in May 2023 was flat from last year and declined 16 percent on a month-over-month basis. Assuming a softer sales level in June, there could see a minor inventory improvement in the upcoming month, but the upward adjustment would be entirely due to a change in the demand side.

Why an economic downturn represents the best time to invest in real estate.

Right now, might seem like a frightening time to jump into real estate investing. But for value-seeking investors, the scariest time to invest is actually in a good economy, when housing prices are rising at a blistering pace according to Sean Moudry, 27-year real estate veteran from Colorado.

This is because it is difficult to identify the top of a market, and nobody wants to buy at the top of the market just to watch the value of their investments fall during a downturn. An economic downturn provides many opportunities that are nearly impossible for the average investor to take advantage of in a good economy.

The market is anything other than typical right now. According to the National Association of Realtors' latest existing-home sales data, sales are down 23.2% and prices are down 1.7% from this time last year. The association's chief economist characterized it as "bouncing back and forth," with interest rates, low inventory, and job gains contributing to "an environment of push-pull housing demand."

Reason #1: Recessions Create More Opportunities to Invest

Due to the massively low housing inventory that isn't likely to change in the near future, housing prices in the retail market are not expected to substantially change, up or down, even if we see a full recession. This is because most homeowners have a low interest rate and an affordable payment, and most homebuyers don't have a lot of economic or social pressures to buy.

The motivated seller category is the submarket where you will find homeowners who are facing financial distresses like bankruptcy, foreclosure, and job loss or relocation. They may also be facing a personally distressing situation such as divorce, health issues, or even a death in the family. Motivated sellers don't have the luxury of time, like the sellers in the retail market do. Their unique situation requires them to resolve their circumstances within a defined time frame.

Reason #2: Economic Factors Will Shift Markets

As we have emerged from the pandemic and now face a slowing economy, some market sectors will remain strong, and others are beginning to decline. We are already seeing the impacts of this. Large expensive cities like San Francisco are continuing to lose population to more affordable areas like Sacramento, California. Cities in Florida are seeing an increase in migration from states with opposing political views. And people are moving away from Florida for the same reason.

During recessionary times, look to invest in areas where the population is growing. Increased population will support rental rates and thus property values. These hot spots will likely outperform other areas in both cash flow and appreciation. During economic slowdowns, second homes and vacations are a luxury that most people will cut back on. Overall, the migration out of expensive cities will begin to increase inventory, making these types of property more affordable.

Reason #3: Don't Wait for the Bottom of the Market

Many people feel that investing in a falling or soon-to-be-falling real estate market is a mistake. But if you take into consideration the bigger picture, now may be the best opportunity for your clients to invest.

Reason #4: Real Estate Is a Hedge Against Inflation

Inflation is the result of the devaluation of the dollar in comparison to the goods and services we buy. Since the dollar is worth less and assets are worth more, many savvy investors know to reduce their cash savings by buying real estate assets as a hedge against inflation. Rental real estate is an ideal asset that will not only protect against the lost value of the dollar but will also provide income during slow economic times.

Reason #5: Housing Supply & Demand

When demand from both buyers and renters outpaces supply, home prices and rents will rise.

According to the Census Bureau, immigration is due to surpass natural population increase by 2030. And by 2060, the U.S. is slated to reach a population of 400 million, putting enormous pressure on demand for housing. Unlike in Italy, U.S. housing prices are expected to rise steeply for the foreseeable future.

The simple, logical solution to solving the supply issue is to build more affordable homes. Nearly 50% of homebuilders did not return after the recession in 2008. Since then, new construction has continued to trail behind demand. Homebuilders are hesitant to invest in new developments during insecure economic times. Shifting real estate markets can leave builders at risk of losing millions of dollars if the market declines greatly before their projects are completed.

But I believe that house values will likely remain strong, and rents will continue to rise, despite an economic downturn. On the other hand, I also think we will see inventory increase due to some homeowners being forced to sell for personal and financial reasons. This will create a few great opportunities. If there's one lesson to take away from all of this, it's this: The good deals will be absorbed quickly, and the U.S. will return to a highly competitive housing market.

Let's look at a local city and market...Watsonville.

Watsonville is a city in Santa Cruz County, in the Monterey Bay Area of the Central Coast of California. The population was 52,590 at the 2020 census. Predominantly Latino, working-class, and Democratic, Watsonville is a self-designated sanctuary city. The Castro Adobe, built by Juan José Castro on Rancho San Andrés, is the oldest building in Watsonville. Watsonville's land was first inhabited by an Ohlone nation of Indigenous Californians. This tribe settled along the Pajaro Dunes since the land was fertile and useful for the cultivation of their plants and animals.

Most of the coastal land adjacent to Watsonville is part of the Monterey Bay National Marine Sanctuary. Another protected natural resource is the Watsonville wetlands, a system of fresh water sloughs with open water and native vegetation that extend from the city to the ocean. The slough system is only one of a few remaining wetland areas of its kind in the California Coastal Region.

Watsonville's main industries are construction, agriculture, and manufacturing. Some of the largest companies headquartered in Watsonville are Monterey Mushrooms, Driscoll's, Martinelli's, Fox Racing Shox, Nordic Naturals, Graniterock, Granite Construction, West Marine, California Giant, A&I Transport Inc. and Orion Telescopes & Binoculars. Some say it is the "Strawberry Capital of the World".

Statically, Watsonville has grown over 16% in population over the past 20 years. The median price for a single-family home has risen from $419,000 in 2003 to $840,000 at the end of 2022. The number of sales for single family homes was 342 in 2003 and rose to a high of 539 in 2009 and ended the year at 188 in 2022. The months of inventory which typically shows whether it is a buyers or sellers' market, was 1.8 months in 2003 and rose to a high of 27.2 in 2007 (recession) and is currently 4.1 months.

Tune in next month where I will preview another city.

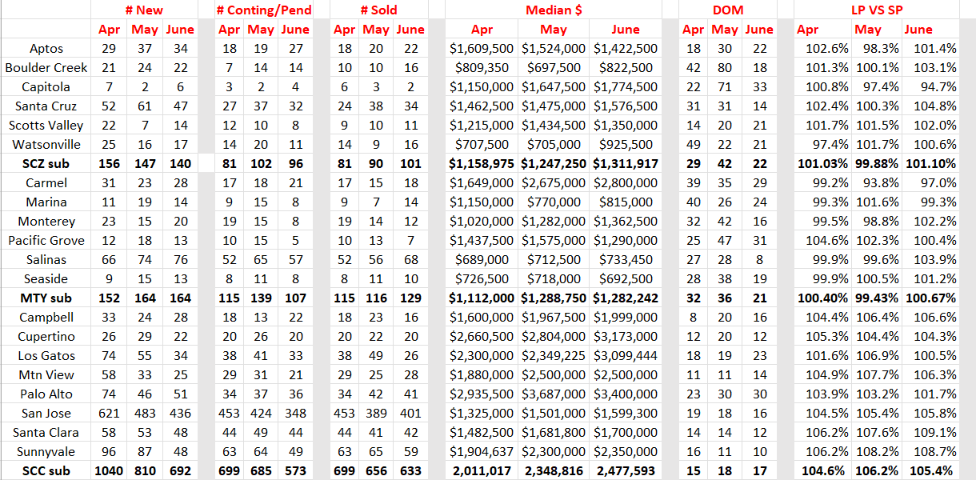

2023 2nd Quarter stats for Santa Cruz, Monterey & the Bay Area

Comments: Typically, June and July are the highest months for new listings, but as you can see new listings and pending sales are down from May across all three countries. On the other hand, sales are up a bit in Santa Cruz and Monterey counties, yet down overall in Santa Clara. This trend should start to trickle down to Santa Cruz and Monterey soon. The median price is up again a little in Santa Cruz and Santa Clara and relatively the same in Monterey County. Still a continued sign of dwindling inventory. Days on the market have declined as we see buyers more active and the list to sales price ratio is up in Santa Cruz 1.22% and 1.24% in Monterey with Santa Clara down only .8%. I see a continuation of this trend though the end of the year and who knows what 2024 will bring, especially with a presidential election. (Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS)