JULY 2024

Home prices nationally begin to cool as active listings jump 35%.

For the four weeks ended June 23, the typical home sold for slightly less than its asking price. A little less than two-thirds of homes, however, sold over asking price in the last month, but that is the lowest share since June 2020. Annual home price growth slipped to 4.6% in May from 5.3% in April. That is the slowest growth rate in seven months according to a report from CNBC. Some of the heat is coming out of home prices, even though they're still higher than they were a year ago. Several new reports show the price gains are shrinking and home sellers are starting to give in after a stagnant spring market.

For the first time since the start of the Covid-19 pandemic, when home sales ground to a halt, the typical house sold for slightly less than its asking price - 0.3% lower - during the four weeks ended June 23, according to real estate brokerage Redfin. A year ago, at that time the typical home was selling at list price. Two years ago it was selling at about 2% above list price. That's not to say that the housing market is crashing. A little less than two-thirds of homes still sold over asking price in the last month; that is, however, the lowest share since June 2020. While most sellers are still listing their homes at higher prices than comparable homes sold for a year ago, some are conceding that they simply can't command those prices.

Mortgage rates remain stubbornly high, with the average rate on the 30-year fixed mortgage stuck just above 7% for the third straight month, according to Mortgage News Daily. The much-watched S&P Case-Shiller index showed home prices in April up 6.3% from April 2023. May's prices continue that trend. Home prices are now 47% higher than they were in early 2020, with the median sale price now five times the median household income.

CNBC got an exclusive, early look at home price data coming out next week from a different index by ICE Mortgage Technology. It shows annual home price growth slipped to 4.6% in May from 5.3% in April. That is the slowest growth rate in seven months. Supply is starting to build, which is leading to the cooling in prices. Total active listings are now 35% higher than they were at this time a year ago, according to Realtor.com. To put that in perspective, however, even after the recent growth, inventory is still down more than 30% from typical pre-pandemic levels.

"Some buyers think they can get a deal because they're hearing the market is cool, and some sellers think every home will sell for top dollar no matter the condition," said Marije Kruythoff, a Los Angeles Redfin agent, in a release. "In reality, everything depends on the house and the location."

State Farm is seeking massive rate hikes in CA.

State Farm is looking to raise insurance rates for some California customers by more than 50% as the insurance giant weighs its future in the Golden State. In a filing to the California Department of Insurance, the company's subsidiary in the state requested to hike homeowners' insurance policies by 30%, condominium policies by 36% and renters' policies by a whopping 52%.

State Farm is asking California regulators to allow the company to raise rates by as much as 52% for some customers. "State Farm General Insurance Company ("State Farm General") is working toward its long-term sustainability in California," the company told FOX Business in a statement. "Rate changes are driven by increased costs and risk and are necessary for State Farm General to deliver on the promises the Company makes every day to its customers."

State Farm is California's largest home insurance provider, and the company has made a number of moves in recent years to pull back on its exposure in the state. The insurance giant announced last year that it would stop accepting new home insurance applications in California due to "historic" increases in construction costs and inflation. California's biggest insurer, State Farm, is asking to hike rates after announcing last year that it would no longer write new homeowners' policies in the state.

Then in March, the company said that it would cut 72,000 home and apartment policies in the state because of inflation, regulatory costs and increasing risks from catastrophes. California's insurance commissioner, Ricardo Lara, referred to the situation as "a crisis" at the time, and is now raising further concerns following the company's new request for rate hikes. "State Farm General's latest rate filings raise serious questions about its financial condition," Lara said in a statement. "This has the potential to affect millions of California consumers and the integrity of our residential property insurance market."

Then-Sen. Ricardo Lara joined union groups gathered together for a rally in Wilmington, California, on Oct. 3, 2018. Lara is commissioner of the state Department of Insurance and has proposed reforms to tackle California's insurance crisis. Lara emphasized that the rate increases would have to be approved by the California Department of Insurance (DOI). The DOI approved a 6.9% rate increase for State Farm in January 2023, and an intervenor group approved a 20% rate hike for State Farm homeowners and condominium policies in December. "We will use all the Department's investigatory tools to get to the bottom of State Farm's financial situation," Lara reiterated. "We take this process seriously."

CA median home price sets another record high.

Mortgage rates that surged to their highest levels since late last year hampered California home sales in May on both a monthly and an annual basis, while the statewide median home price exceeded $900,000 for the second straight month to set another record-high, according to C.A.R.'s most-recent home sales and price report. May's sales pace dipped 1.1 percent from the revised 275,540 homes sold in April and were down 6.0 percent from a year ago, when a revised 289,860 homes were sold on an annualized basis.

The statewide median price set another record high in May, edging up 8.7 percent from $835,280 in May 2023 to $908,040 in May 2024, exceeding the $900,000-benchmark for the second month in a row. California's median home price was 0.4 percent higher than April's $904,210.

VA allows Veterans to pay buyer-broker fees in competitive markets.

On June 11, the Department of Veterans Affairs (VA) issued Circular 26-24-14 to announce a temporary local variance that allows veterans to pay reasonable and customary buyer-broker charges when purchasing a home beginning August 10, 2024.

The purpose of this temporary variance is to ensure veterans remain competitive buyers in the rapidly changing real estate market. The VA plans to develop a more permanent policy through rulemaking, but that is a longer process requiring a public comment period.

The circular encourages veterans to negotiate buyer-broker fees and clarifies that sellers can still pay these charges without it being considered a seller concession. It also provides instructions for lenders on processing loans with buyer-broker charges paid by the veteran.

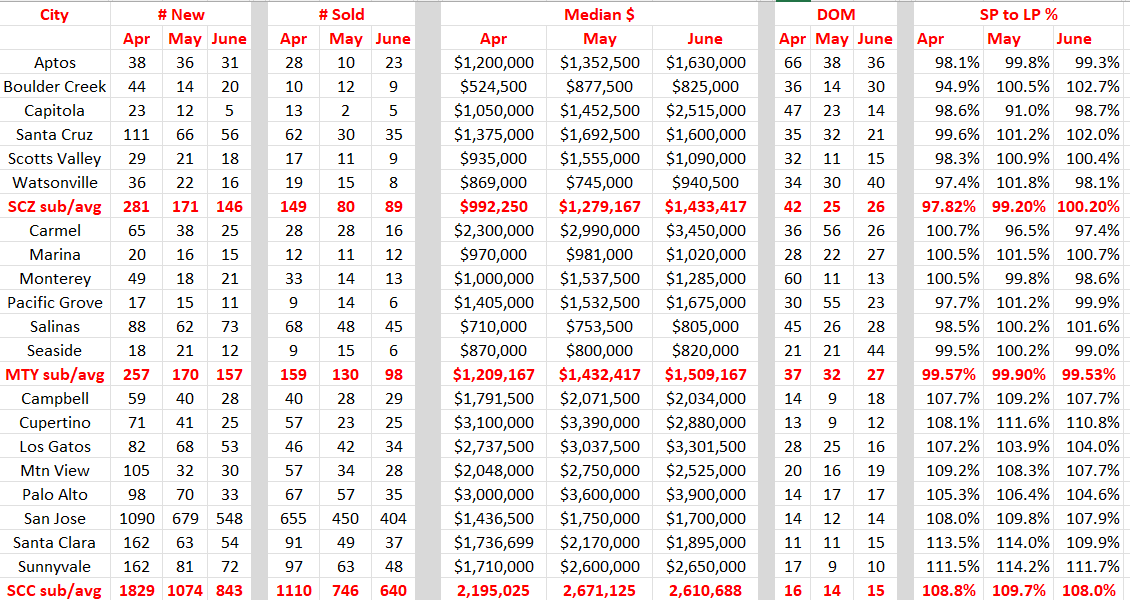

2nd Qtr. Stats for Santa Cruz & Monterey Counties & the Bay Area

Comments: June did not exceed May following in the footsteps of the previous report. There is something understandably weird going on. Fewer new listings across all three counties. Fewer sales except for Santa Cruz. Prices are up in Monterey and Santa Cruz and slightly down in Santa Clara. The days on the market showed some notable change in some areas up and down, but on average per county about the same. Same thing with sale to list price.

Once again let's look at what is selling. When I look at Santa Cruz, 82 out of 114 sales were over $1M. 58 were over $14M. In Monterey, 71 out of 133 were over $1M. 37 were over $1.5M and beyond. In Santa Clara, 777 out of 819 were over $1M. 240 were over $2.6M+. If this trend continues, the decline will continue, and prices will remain high. It will take an interest rate reduction to eventually see some real change.(Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS as of 6/30/24)