August 2021

California is not building enough housing

Pandemic home renovations rise in first half of 2021

According to a recent Harris poll, home renovations surged during the pandemic, and homeowners are embracing major redo's that increase their homes' value.

More than half (55%) of more than 2,000 U.S. homeowners surveyed said they made substantial improvements to their homes that they believe will boost their home's value, according to a July survey commissioned by Selective Insurance and conducted by The Harris Poll. That marks a 25% increase in large-scale home improvement projects reported by homeowners compared to its December 2020 survey results.

The study also found the prevalence of home renovations by region: Northeast (54%, down from 56% in December 2020), South (57%, up from 40% in December 2020), Midwest (52%, up from 42% in December 2020), and the West (55%, up from 43% in December 2020).

Similar trends among customers who operate contracting businesses were noted. An analysis of active commercial liability insurance policies identified a 5-10% increase in residential construction payroll and an approximately 15% increase in subcontracting costs year over year from 2019 through 2021.

Homeowner equity surges during hot housing market

Thirty-four percent of residential properties in the U.S. with a mortgage were considered "equity rich" in the second quarter, which means the combined estimated amount of loans secured by the properties was at least 50% of its estimated market value, according to ATTOM Data Solutions. The number continues to grow, increasing from 31.2% in the first quarter and 27.5% in the second quarter of 2020.

On a metro level, the areas in California with the highest share of mortgaged properties that were equity rich in the second quarter were: San Jose: 69.4% equity-rich; San Francisco: 64.9%; Los Angeles: 57.9%; and San Diego.

The report also shows that just 4.1 percent of mortgaged homes, or one in 24, were considered seriously underwater in the second quarter of 2021, with a combined estimated balance of loans secured by the property at least 25 percent more than the property's estimated market value. That was down from 5.2 percent of all U.S. properties with a mortgage in the prior quarter and 6.2 percent, or one 16 properties, a year ago.

Prices have continued rising over the past year as rock-bottom interest rates and a desire to escape virus-prone areas have led to a bubble of home buyers largely untainted by the pandemic's financial damage. Those buyers have been chasing a declining supply of properties for sale throughout the past year, resulting in elevated demand and soaring values.

Among 1,536 counties that had at least 2,500 homes with mortgages in the second quarter of 2021, 17 of the top 20 equity-rich locations were in the West region. The highest concentration again was in the San Francisco Bay area of California.

7 Steps to protect your smart home tech from hackers

1. Adopt Better Password Habits

2. Enable Automatic Updates for Cybersecurity

3. Secure the Router

4. Host Smart Tech on Separate Networks

5. Find a Qualified Cybersecurity Service

6. Penetration Test the System

7. Factory Reset Equipment Before Upgrading

The vast interconnectivity of a smart home can be risky, but it doesn't have to spell disaster. If you follow these cybersecurity steps when setting up a network, you can ensure all devices are safe from hackers.

Smart home installers and owners can't afford to ignore cybersecurity. A few vulnerabilities can turn this technology from convenient to dangerous. Taking time to protect these devices ensures that they won't be more trouble than they're worth.

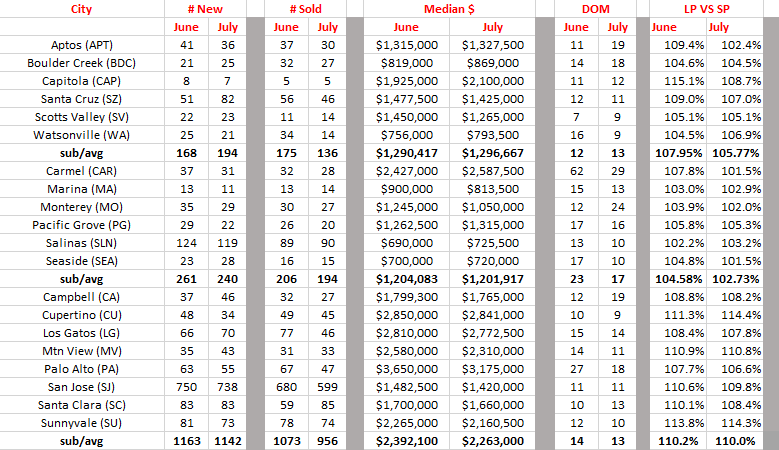

June-July statistics for Santa Cruz, Monterey & the Bay Area

Comments: As is typical for this time of year, we start to see a change in new listings vs sales. This seems to be true as all three counties showed a decline in sales with just Santa Cruz having a slight increase in new listings. The Santa Cruz and Monterey median price in July stayed similar to June with a 5.4% decline in Santa Clara. Days on market remains low with the list to sales price ratio dropping over 2% in Santa Cruz and Monterey counties. Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS.