September 2022

Is there market uncertainty ahead of us in California?

According to the latest information reprinted here directly from the California Association of Realtors (C.A.R.) some of the latest reports on consumer confidence and housing sentiment might have painted a more positive picture for the housing market conditions in August. Recent developments in the lending environment and the financial market suggest that we could see more market uncertainty ahead of us. With interest rates rising sharply and the S&P 500 index falling nearly 9% since mid-August, the housing market will likely encounter more headwinds in the fall as the risk of recession looms large while high inflation remains a concern.

What may down the road for some cities in the Bay Area

A group of Los Gatos residents is launching a ballot-box challenge to the town's 2040 General Plan for planning for too many housing units. The Los Gatos Community Alliance filed a referendum against the plan that was approved by the town council in June. The alliance believes that more apartment complexes will negatively impact the "small town atmosphere" and aesthetics of Los Gatos. If the group gathers 2,200 signatures, the Town Council would be forced to either place the referendum on an upcoming ballot or rescind the General Plan.

The California Department of Housing and Community Development (HCD) has taken the unprecedented step of initiating a review of the City and County of San Francisco’s housing processes. San Francisco has the longest timeline in the state for advancing housing projects to construction, has among the highest housing and construction costs, and has been the subject of more complaints to the state agency than any other local jurisdiction.

The County of Santa Cruz proposes a Santa Cruz Branch Line Corridor which they determine will represent a substantial asset for the county, but despite multiple studies costing millions of dollars conducted over decades to study its use as a commuter rail corridor, it is still not being utilized for commuter services. A proposed initiative supports a plan for interim use of most of the Corridor as a high-quality, multi-use trail (Greenway). The Greenway would allow for commuting, active transportation, and recreation while preserving the option for future rail use through rail banking, including bridges and trestles, for potential rail use.

According to the Palo Alto Weekly, the city is considering raising the height limit to allow for the construction of much needed affordable housing. The City’s proposed housing element includes a variety of policies that would allow residential developments to exceed the existing 50-foot limit. For decades, the height limit has kept most residential development to four stories or less.

Two bills currently before the California legislature create housing agencies with the power to impose a range of new property taxes on homeowners. SB 1105 grants an unelected six-member body broad power to unilaterally raise a very wide range of taxes on homeowners and real property generally. The taxes that these agencies could impose would make owning a home more expensive in a time of serious economic stress and rising prices and could also put homeownership further out of reach for working families. And the list goes on…………

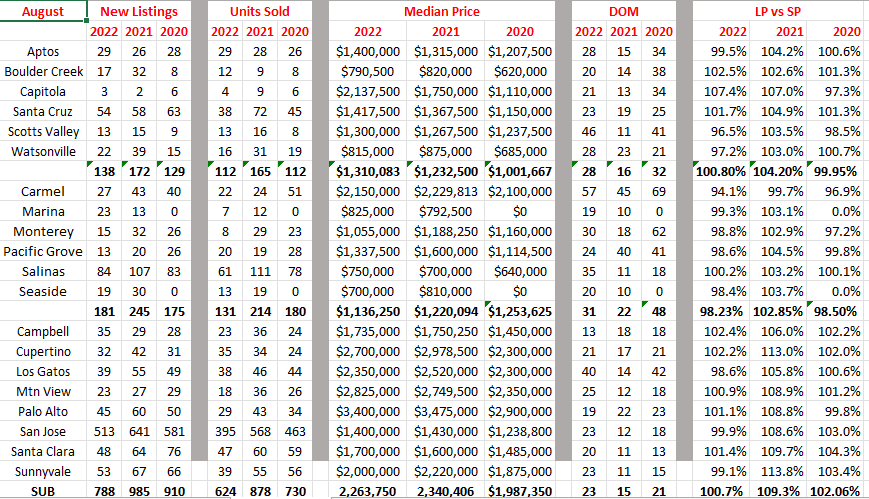

3-yr August Comparisons for Santa Cruz, Monterey & the Bay Area

Comments: What a difference a pandemic can make. New listings by county up and then down year over year since 2020. Median price is never a factor to consider in mind due to what price ranges sold when. Days on Market and list to sale price ratio the same, down year over year since 2020. So, are we getting back to “normal” or are there more changes to come up and down? (Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS)